In a land far-far away called ThisPlaceDoesn’tExistVille……everyone spends the same amount of money every month.

That means of all 12 months of the year, a person will spend maybe $4,000/mo for living/fun/bills. Like this:

January spending: $4,000

February spending: $4,000

March spending: $4,000

November spending: $4,000

December spending: $4,000

BAHAHAHA!! In RealWorldLand however, that shit NEVER happens! It’s more like:

January spending: $4,000

February spending: $3,000

March spending: $4,000

November spending: $7,500

December spending: $11,500

Notice those last few months shoot straight up.

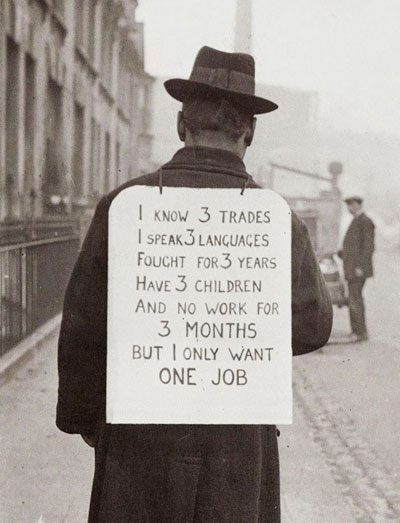

Well pretty much EVERY year ever, I notice my spending goes sky-high in the last quarter of the year….and I’m not alone in this.

In October/November/December you tend to: Travel places to see family, buy lots of gifts, go to lots of parties, stay in other places…..basically A LOT OF SPENDING HAPPENS.

But years ago in college I did one smart thing, and that was create a separate spending account JUST for occasions like this.

I called it The Spending Account 2.

(ok…the name wasn’t so creative, but you get the point)!

In college I started stuffing in about $300 bucks a month to the Spending Account 2 account….so by the end of 12 months I’d have an extra $3,600 in the holiday season to spend.

At the time that would cover travel costs, allow me to buy some pretty decent gifts for everyone….and essentially lemme have some extra wiggle room to do/buy whatever I wanted for the holidays:

Having The Spending Account 2 available for extra money made holiday shopping a lot more enjoyable, when you didn’t have to “budget” to buy stuff on your normal monthly burn rate.

If you have the option to create multiple bank accounts, I’d HIGHLY suggest you create a separate one that let’s you actually enjoy the holidays instead of dread it :)

Sincerely,

Neville Medhora – The Brown Santa Claus

P.S. You’re damn right I made a financial graphic using Emjoi!