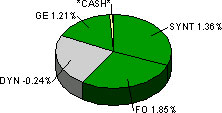

This chart shows the daily movement of my portfolio only.

This chart shows the daily movement of my portfolio only.

I was asked about my stock portfolio several times lately. I enjoy having a long term portfolio which just sits there. I’ve tried active trading and it isn’t for me. I leave that up to Kirk.

Here are the current stocks I own and reasons I bought them:

Dynegy (DYN) – Got pummeled after the Enron scandal. I hold this as a long term turnaround stock. Dynegy deals mainly with natural gas. They keep paying off their debt which short term investors hate, but long term investors like. Has put me at 25% gains at times and at a 30% loss at times.

Syntel (SYNT) – An Indian outsourcing firm with relatively little media coverage. Healthy company with no debt and an ever-expanding operations. On days when the NASDAQ does well, Syntel does really well….but when NASDAQ performs poorly, Syntel performs very poorly. Who cares, I am in it for the long haul.

Fortune Brands (FO) – Conglomerate with a million different brands under their name. Company has balanced their portfolio of brands to survive in good or bad markets. I idolize this company and its great track history.

General Electric (GE) – Bought as a “rock” which moves neither up or down very fast. GE dabbles in jet engines, water treatment, appliances, television stations and much more.

—————————-

On another note, I’ve started preliminary research for my traffic experiment. I went to three different tall buildings adjacent to I-35 and got permission to take pictures of the rush hour traffic.

I’ll explain later.

—————————-

Even though the Fall semester is over with (I have one more summer to take and I should be done), I have been gallivanting across town trying to strike up some new business deals here and there.

I want to have a good amount of moola in reserve by the time I get out of college for good.